The roots of the insurance talent crisis trace back decades, but it has continued to grow at an accelerating pace, becoming one of the most formidable competitive challenges to both individual insurers and the industry as a whole. But how did it get to this point?

Since 2010, the number of insurance professionals over 55 has increased 74%, leading the U.S. Bureau of Labor Statistics to predict that 50% of the current worAkforce will retire over the next 10 years. This sudden mass exit from the job market will leave more than 400,000 insurance positions unfilled. Meanwhile, the demand for critical roles like expert underwriters, claims handlers, and data analysts is already outpacing supply.

Insurers of all sizes are now in a race to transform their workplace culture and reshape their employee experience strategy to remain competitive and address the talent shortage head-on. In part two of our True Spotlight on Employee Experience, we explore the history of the insurance talent crisis, examine the pivotal technological, social, and generational shifts that caused it, and look at its profound impact on the insurance industry.

Innovation Amplifies Demand for New Skills

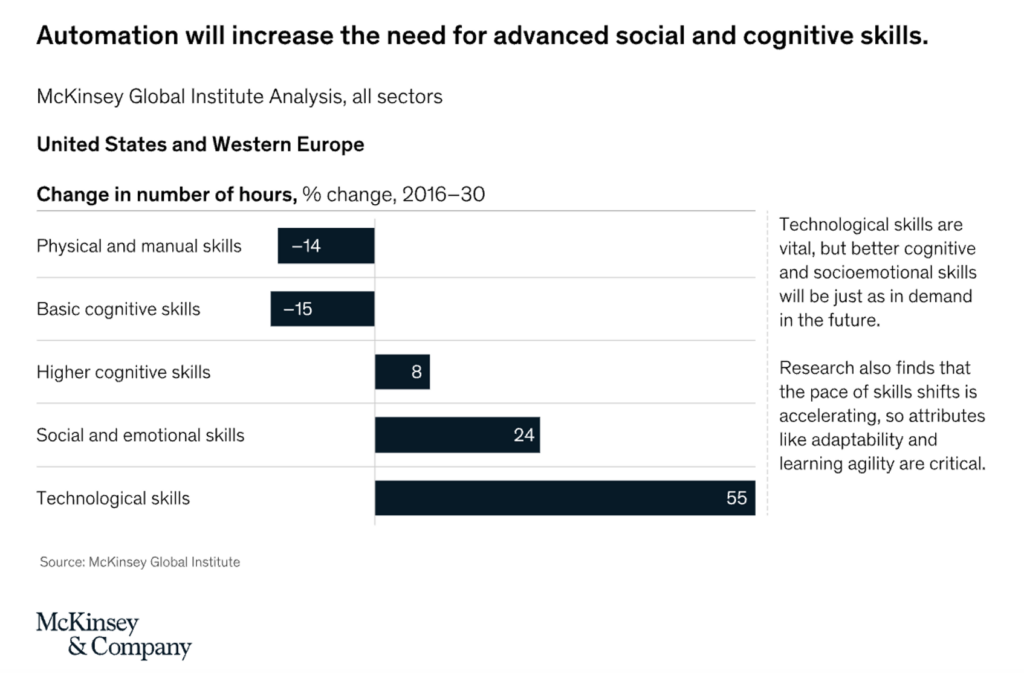

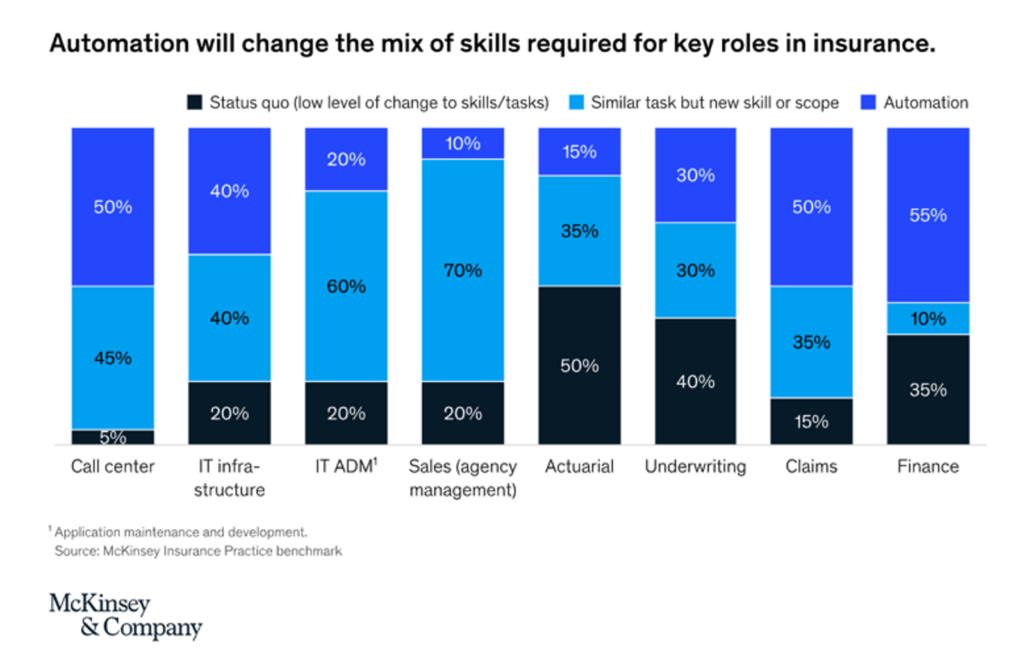

The adoption of integrated cloud-based solutions, automation, and data analytics has opened new growth opportunities for insurance leaders, yet has also driven up demand for new skill sets outside the scope of traditional roles. Data analytics and business intelligence expertise, for example, are now highly sought-out capabilities for all industries, which only multiplies competitive intensity for insurers. This cross-industry battle for talent necessitates a proactive approach to talent strategy including reskilling, fostering employee development, and utilizing automation to increase capacity for knowledge work.

Acceleration of digitization during the COVID-19 pandemic changed the office landscape. Remote work has underscored the importance of digital proficiency and adaptability, making the ability to collaborate effectively in virtual environments a critical workplace skill.

Old Tech Repels Highly Skilled Candidates

While many insurers have adopted digital transformation, creating demand for employees with a stronger technical skill set, still many others have been slow to transform. The insurance industry’s reputation for relying on antiquated legacy and homegrown systems is driving away top talent who demand to work with cutting-edge technology.

Shifting Social Perceptions & Generational Values

The social and generational shifts taking place in the workforce have also played a significant role in exacerbating the talent crisis. Baby boomers, a significant portion of the insurance industry’s workforce, are retiring, taking their decades of experience with them. Simultaneously, the entry of Generation Z candidates into the candidate pool introduces an interesting dynamic, bringing with them a fresh perspective that is influenced by growing up in an era of rapid technological advancement and constant connectivity.

Gen Z and Millennial workers desire meaningful, purpose-driven work guided by aspirations that differ from those of their predecessors, preferring roles that leverage modern technology and align with their values. These digital natives seek inclusive workplaces that prioritize innovation, digital proficiency, and a broader societal impact facilitating the need for a reimagined approach to talent management.

Zurich

While the exit of experienced professionals underscores the urgency of preserving institutional knowledge, the entry of tech-savvy and purpose-oriented generations offers an opportunity for insurers to reshape their strategies and embrace innovation to remain relevant and competitive.

Employees Seek Workplaces that Promote Growth & Development

The scarcity of skilled professionals has transformed the employee-employer dynamic pushing insurers to rethink their value proposition. Competitive salaries are no longer sufficient; employees seek opportunities for skill development, career advancement, and a modern, technologically rich work environment. As the Gallup State of the American Workplace report reveals, employees who believe their company offers opportunities for professional growth are more likely to stay.

The Big Picture

Insurers that fail to attract and retain top talent may struggle to innovate, adapt to changing customer expectations, and develop data-driven strategies. To maintain competitive relevance, insurers must recognize the symbiotic relationship between talent, technology, and innovation and address this crisis head-on to be well-equipped to navigate the challenges and opportunities of the future.

What’s Next?

For the first time in industry history, five generations (Silent Generation, Baby Boomers, Gen X, Millennials, and Gen Z) of insurance professionals are currently, actively employed. In the next entry in the True Spotlight on Employee Experience series, we’ll analyze the current state of the insurance workforce and learn how changing values across generations have redefined talent strategy for the entire industry.

Learn more about our suite of integrated workers’ comp policy and claims administration solutions and how True can help your organization deliver powerful employee experiences or reach out to our team to schedule a discovery call.

Additional Resources

Attracting talent in an insurance industry talent crisis, PWC

Talent crisis will drive change in insurance, Property & Casualty 360

For US Property and Casualty, Okay Isn’t Good Enough, BCG

2021 Insurance Industry Workforce Trends, BCB

With Challenge Comes Opportunity: How Networking, Apprenticeship & Mentoring Can Help with Today’s Talent Crunch, Insurance Journal

This Just In: Insurance Isn’t Boring, III

Church Mutual President: Getting, Keeping Talent Is “Number One Challenge”, III

Nurturing Tomorrow’s Risk & Insurance Leaders, III

15 Benefits of Working at an Insurance Company, Indeed

How to reduce the insurance-industry talent gap, Property & Casualty 360

6 strategies for the insurance industry to attract and retain millennials, Eightfold.ai

How can the insurance industry appeal to Gen Z? | Insurance Business America, Insurance Business

4 Ways to Sell Gen Z on an Insurance Career4 Ways to Sell Gen Z on an Insurance Career, Independent Agent Magazine

How is Gen Z changing the workplace?, Zurich

Gen Z: Insurers Must Learn to Connect with the ‘Most’ Generation, Insurance Innovation Reporter