Navigating the complexities of workers’ compensation insurance demands more than just efficiency—it requires a seamless, integrated customer experience. This article, the latest in our series on Customer Experience, dives into the importance of omnichannel strategies, their benefits, and how leading insurers are implementing them to boost service delivery.

Understanding Omnichannel Strategies

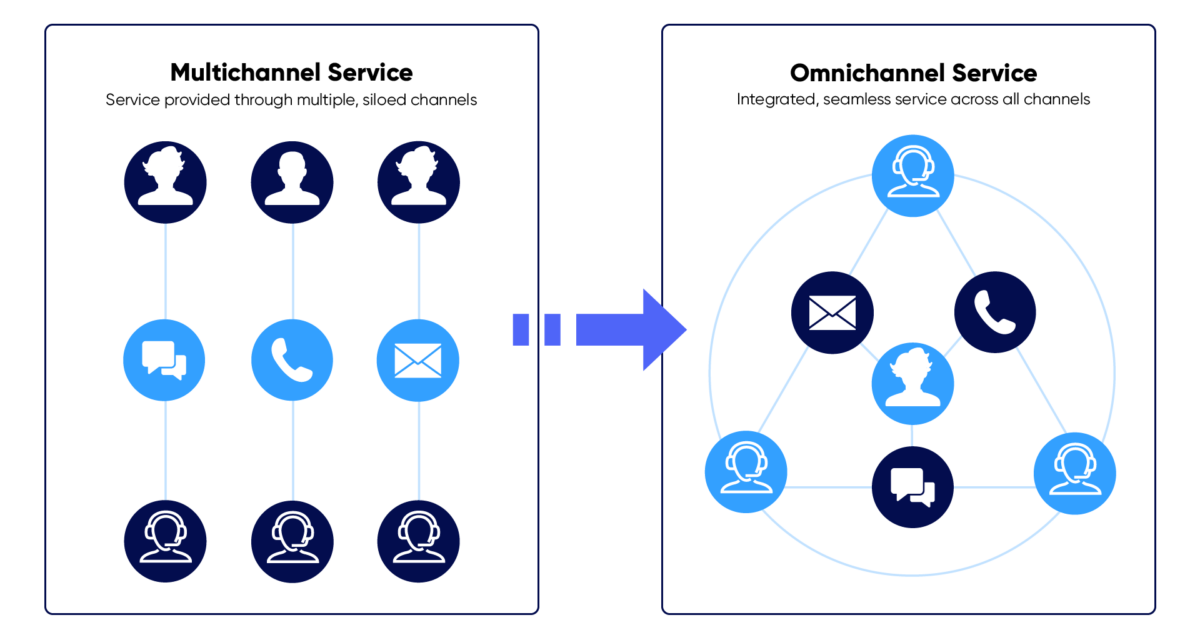

Omnichannel strategies focus on creating a seamless and unified customer experience across multiple communication channels to provide a cohesive customer experience. Unlike multichannel approaches, where each channel operates independently, omnichannel strategies ensure all channels are interconnected into a single ecosystem, allowing for a consistent customer journey, regardless of the touchpoint:

- Unified Customer Profiles: Information from different channels is consolidated into a single profile, giving agents a complete view of the customer’s history and preferences.

- Seamless Channel Switching: Customers can switch between channels (e.g., from chat to email) without having to start their query from scratch.

- Consistent Messaging: Ensures that the brand voice and service quality remain consistent across all platforms.

- Centralized Data Management: Collects and analyzes data from all interactions to continually improve service quality and customer insights.

The Importance of Omnichannel in Workers’ Comp

Workers’ compensation insurance is complex, involving numerous stakeholders such as policyholders, injured workers, medical providers, and claims adjusters. Providing consistent and timely information to all parties is crucial for smooth system functioning. Omnichannel strategies achieve this by offering a cohesive experience across all communication channels.

Benefits of Omnichannel Strategies

- Enhanced Customer Satisfaction: A unified approach ensures customers receive consistent information, reducing confusion and increasing satisfaction.

- Improved Efficiency: Integrating channels streamlines operations, cutting down redundant tasks and boosting overall efficiency.

- Better Data Insights: Consolidated data from various channels provide comprehensive insights into customer behavior, enabling informed decision-making.

- Increased Engagement: Consistent messaging across channels fosters better engagement and builds stronger relationships with customers.

- Higher Retention Rates: Satisfied customers are more likely to return and recommend the business, driving growth through positive word-of-mouth and repeat business.

- Competitive Advantage: In an era where customer experience is a key differentiator, omnichannel service can provide a significant edge over competitors.

To successfully implement an omnichannel strategy, insurers must focus on several key areas:

- Technology Integration: Leveraging advanced technology to integrate various communication channels is crucial. Our platform, including TruePolicy™, TrueClaims™, and TruePortals™, supports seamless data sharing and communication, providing a consistent customer experience.

- Customer-Centric Approach: Understanding customer needs and preferences is fundamental. True solutions are designed to meet these needs effectively, offering user-friendly interfaces and comprehensive self-service options.

- Continuous Improvement: Regularly analyzing data and customer feedback to refine and improve the omnichannel strategy ensures it remains effective and relevant. Our commitment to continuous improvement is evident in its adaptive technology and customer-driven enhancements.

Seamless Integration for Enhanced Customer Experience

True is dedicated to transforming the customer journey through innovative technology and a customer-centric approach. Our suite of integrated solutions exemplifies our commitment to seamless integration and superior service delivery. By leveraging modern technology to unify communication channels and streamline processes, we ensure that every customer interaction is consistent, efficient, and personalized. Whether it’s policy administration, claims management, or customer interactions, True Insurtech Solutions provides the tools needed to optimize every touchpoint in the workers’ compensation insurance landscape. This holistic approach not only enhances customer satisfaction but also drives operational efficiency and fosters long-term loyalty.

TruePolicy™: Streamlining Policy Administration

TruePolicy™ boosts efficiency and streamlines policy administration for workers’ comp insurance. By integrating all policy administration tasks into a single platform, TruePolicy™ enhances operational efficiency and reduces the risk of errors. This seamless integration is crucial for maintaining a consistent customer experience across various touchpoints.

TrueClaims™: Optimizing Claims Management

TrueClaims™ modernizes claims handling with automations and workflows that accelerate speed and boost efficiency. By providing comprehensive claims management from FROI to closure, TrueClaims™ ensures that all stakeholders have access to up-to-date information, enhancing the overall customer journey.

TruePortals™: Enhancing Customer Interactions

TruePortals™ offers 24/7 self-service with custom-branded, fully integrated portals. This feature-rich solution empowers users to manage their policies and claims with ease, improving satisfaction and operational efficiency. TruePortals™ facilitates seamless payroll and claims reporting, document management, and secure access to essential information, transforming customer interactions.

Best Practices for Successful Implementation

In a world awash with shiny tech gadgets and gizmos, selecting the right tools for your digital transformation can feel like finding a needle in a haystack. Focus on scalability, security, and how well new tech plays with your existing systems. It’s not about having the most toys, but the right ones.

Streamlining the Operation: Reengineering Processes

- Invest in the Right Technology: Choose technology partners who provide solutions that support robust integration and data-sharing capabilities.

- Train Staff: Ensure all team members are well-versed in using the integrated systems and understand the importance of a consistent customer experience.

- Monitor and Adapt: Continuously monitor performance metrics and customer feedback to make necessary adjustments to the strategy.

- Focus on Personalization: Use data insights to personalize interactions and provide a tailored experience for each customer.

Next Steps

Omnichannel strategies are essential for creating seamless customer journeys in workers’ comp. By integrating various communication channels and focusing on a customer-centric approach, insurers can significantly enhance service delivery, improve customer satisfaction, and drive operational efficiency. Leading insurers who have successfully implemented these strategies demonstrate the transformative power of omnichannel approaches, positioning them at the forefront of industry innovation and customer service excellence.

Ready to transform your customer experience with a robust omnichannel strategy? Reach out to our team to discuss how our suite of products—TruePolicy™, TrueClaims™, and TruePortals™—can help you achieve your goals. Contact Ryan Smith at ryan@experiencetrue.com to learn more.

Additional Resources

- Omnichannel Consumer Interactions: A Payer Perspective

- Redefine the Omnichannel Approach: Focus on What Truly Matters

- Forbes Article on Omnichannel Marketing

- JetBlue and Gladly: Omnichannel Customer Service

- How B2B Businesses Can Get Omnichannel Sales Right

- Forrester Report on Omnichannel

- Intelligent Automation in Financial Services

- IBM on Omnichannel Customer Service

- Future Customer Experience

- Reimagining the Claims Ecosystem Through Digital Transformation