In workers’ compensation insurance, advancements in data integration and automation are reshaping claims administration. These technologies are enhancing accuracy, efficiency, and satisfaction for both customers and employees. Let’s explore the top 10 innovations transforming the industry and why they are essential for modern claims administration.

1. Enhanced Decision-Making Through Data Integration

Data integration consolidates information from various sources into one comprehensive system. This unified approach allows insurers to have all necessary information about a claim—such as policy details, billing information, and customer interactions—readily available. TrueClaims™ excels in this area by integrating all relevant data into a single platform. Having all relevant data in one place enables insurers to make more informed decisions. This holistic view helps identify trends, address potential issues, and make strategic adjustments.

2. Streamlined Processes with Automation

Data integration reduces redundancy and eliminates the need for manual data entry, speeding up administrative tasks. TrueClaims™ automates workflows from the First Notice of Loss (FNOL) to claim closure, ensuring a seamless process. Automation accelerates the claims process by handling routine tasks such as document management, notifications, and payments. This allows employees to concentrate on more complex and rewarding work.

3. Improved Accuracy and Reliability

By minimizing errors that often arise from handling multiple data sources, TrueClaims™ ensures that insurers can track and review claim activities accurately, keeping all data up-to-date and consistent. This reliability improves customer outcomes and enhances employee confidence and job satisfaction.

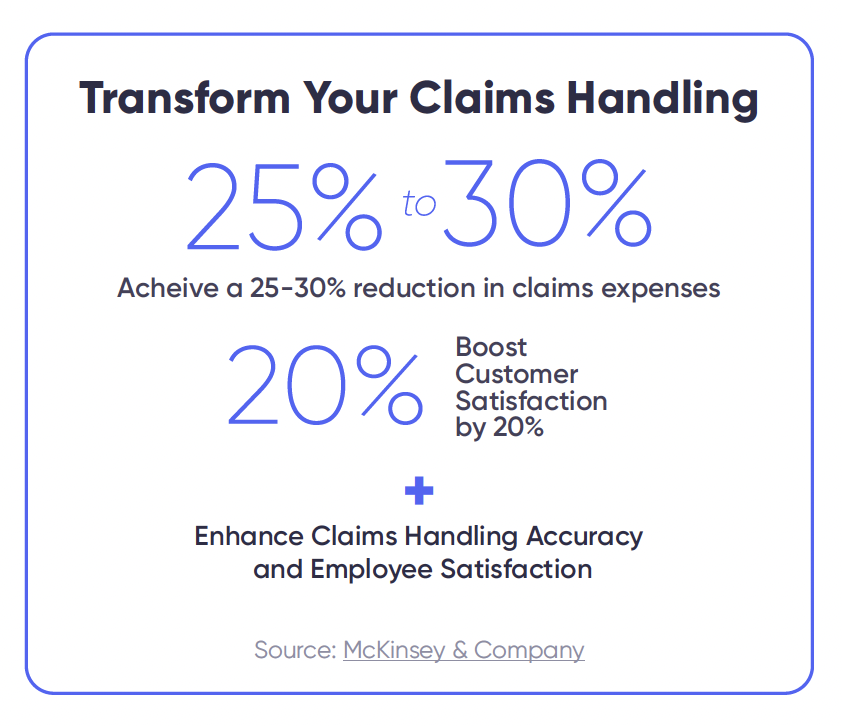

4. Increased Efficiency in Claims Handling

Automation accelerates the claims process by handling routine tasks. TrueClaims™ reduces payment times and processing costs with efficient payment options, including ACH, credit card, and mobile payments. This efficiency allows employees to focus on strategic, impactful work rather than getting bogged down with repetitive tasks.

5. Consistent Communication with Automated Tools

Automated communication tools ensure that customers are kept informed throughout the claims process. TrueClaims™ can automatically generate and send emails, letters, and notifications, enhancing transparency and customer satisfaction. Employees benefit from consistent communication templates, reducing manual effort and potential errors.

6. Advanced Reporting and Analytics

Automation tools like the features in TrueClaims™ offer advanced reporting capabilities, enabling insurers to track claims activities, measure performance, and make data-driven decisions. The platform’s interactive dashboards and business intelligence tools provide valuable insights for continuous improvement.

7. Predictive Insights with Artificial Intelligence (AI)

AI and machine learning are pivotal in predicting claim outcomes, detecting fraud, and optimizing workflows. TrueClaims™ leverages AI to automate processes and provide predictive insights, helping employees tackle complex issues with greater efficiency.

8. Scalability and Flexibility with Cloud Computing

Cloud-based platforms like TrueClaims™ offer scalability, flexibility, and security. They enable insurers to manage data and processes from anywhere, facilitating seamless integration and automation. Employees benefit from the flexibility to access critical information remotely, promoting a more agile and responsive work environment.

9. Strategic Analysis with Advanced Data Analytics

Advanced data analytics tools are essential for interpreting large volumes of data. TrueClaims™ integrates powerful analytics to improve claims administration, allowing employees to focus on strategic analysis rather than data gathering. This analytical capability helps insurers identify patterns and trends that can inform better decision-making and strategic planning.

10. Enhanced Customer Satisfaction

Integrating data and automation in claims administration not only improves internal processes but also significantly enhances customer satisfaction. Quick, accurate claims processing and transparent communication lead to better customer experiences. TrueClaims™ ensures that customers receive timely updates and efficient service, building trust and loyalty.

What’s next?

The integration of data and automation is transforming claims administration in the workers’ compensation industry. By leveraging these technologies, insurers can enhance accuracy, efficiency, and satisfaction for both customers and employees. TrueClaims™ exemplifies how modern platforms can streamline operations, reduce costs, and provide valuable insights. Embracing these advancements not only boosts operational efficiency but also empowers employees to engage in more meaningful and impactful work, offering a competitive edge in the market.

Ready to transform your claims administration with data integration and automation? Reach out to our team to discuss how True solutions can help you achieve your goals or contact Ryan Smith at ryan@experiencetrue.com to learn more.

Enjoy our content? Follow us on LinkedIn or Join the True Community to unlock even more workers’ comp news, events, educational opportunities, resources and more!