AI is reshaping workers' comp.

Are you ready?

This year’s MCSIGA conference was all about AI—and for good reason. From claims automation to communication efficiency, the technology is here. The question isn’t whether to adopt AI, but how to do it in a way that serves your members, protects compliance, and lightens the load on your team.

Welcome back, MCSIGA. We’ve been busy since last year, and we’re excited to show you what’s new. From our newest AI-powered innovation to enhancements across our core platform, True is here to help Michigan self-insured groups navigate the future with confidence.

Your challenges haven't gotten easier

Let’s be honest about what’s keeping Michigan SIGs up at night in 2025:

Legislative Uncertainty is Mounting

Between SB 245's bad faith provisions threatening 11-21% cost increases, SB 1079's retroactive disability redefinitions, and intensified fraud enforcement, the regulatory landscape feels more volatile than ever. Your operations need to be both agile and bulletproof.

Small Teams Are Stretched Impossibly Thin

You're managing compliance, claims, member communications, safety programs, and broker relationships—often with the same headcount you had five years ago. Every hour spent on manual tasks is an hour you're not spending on strategic work that moves the needle.

Communication Creates Constant Compliance Exposure

Every email to an injured worker. Every policy update to member employers. Every claims status message. Each one carries compliance risk, brand implications, and the potential to either strengthen or erode trust. And right now? Most of that communication is being drafted manually, reviewed repeatedly, and still doesn't feel quite right.

The Truth:

Technology should make your job easier, not add another system to manage. That’s why we’ve spent the last year building solutions that actually solve these problems—not create new ones.

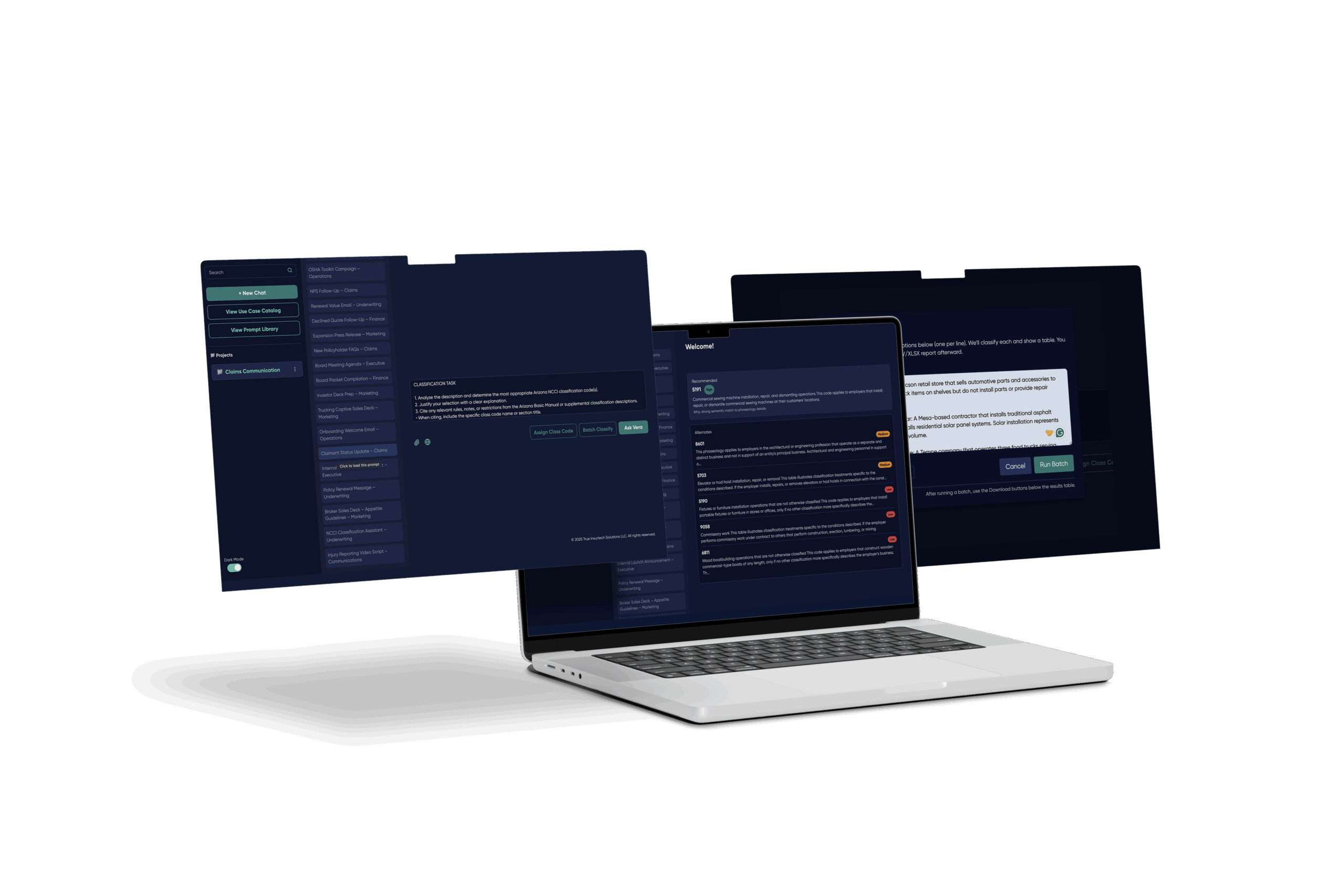

Meet Vera:

AI-powered communication

that sounds human, stays compliant,

and saves hours every week

Since we last saw you at MCSIGA, we’ve been working on something different. Not another data analytics tool. Not another claims dashboard. We built Vera, an AI communications engine purpose-built for workers’ compensation.

What Vera Does

Vera transforms how you communicate with members, injured workers, brokers, and TPAs. She drafts clear, compliant, on-brand messages for every situation—from claims updates to safety bulletins to policy changes—in seconds, not hours.

Why it Matters for Michigan SIGs

Saves Time

on Every Message

Keeps You Compliant

by Default

Scales

Consistency

Improves

Member Experience

The Result:

What used to take your team 2-3 hours of drafting, editing, and approval cycles now takes 10 minutes. Your messages are clearer. Your compliance is tighter. Your team has bandwidth to focus on complex cases that actually need human judgment.

See Vera in Action

You’ve read what Vera can do for your team. Now see how she does it.

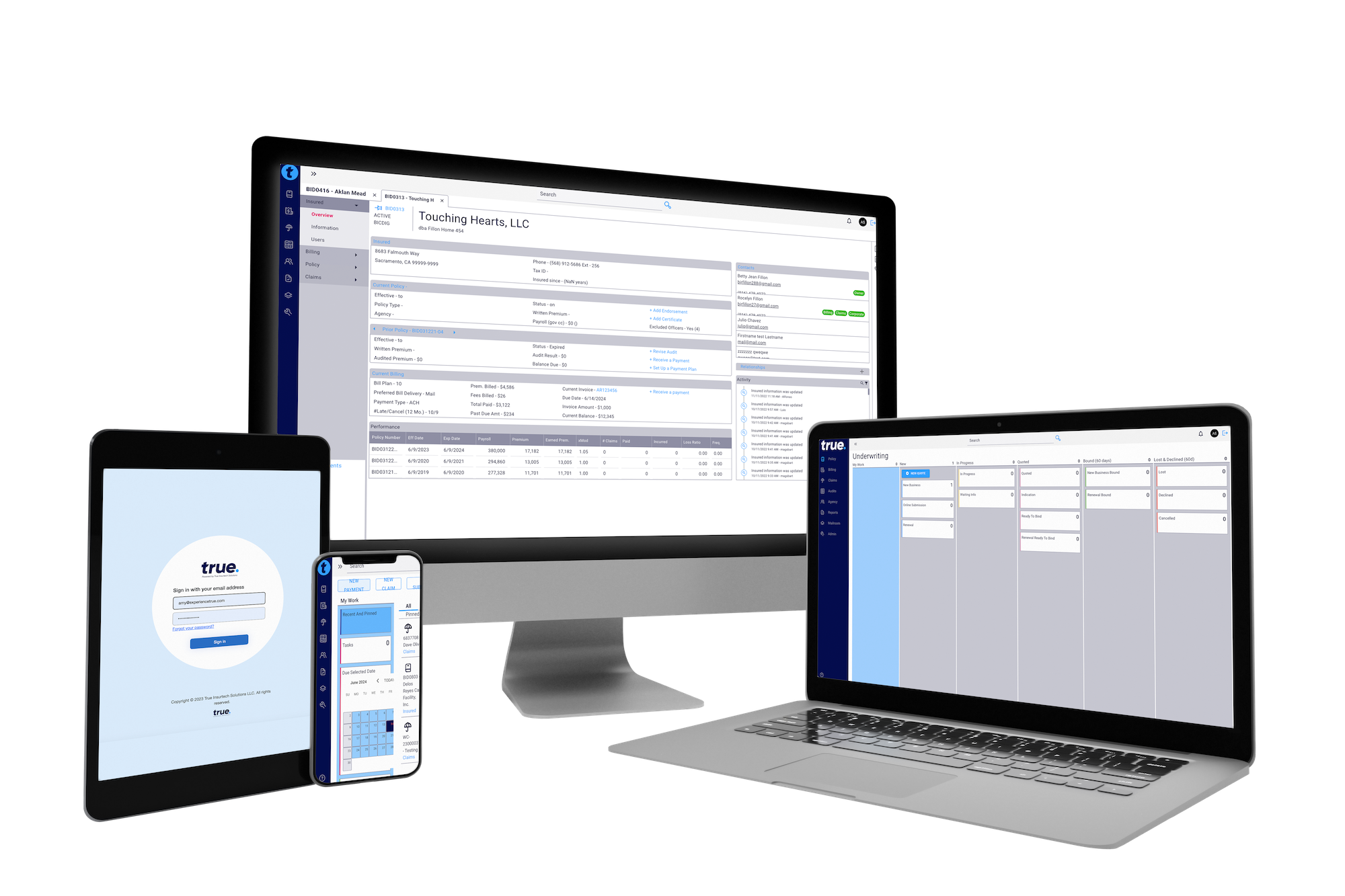

The platform built for workers' comp operations

Vera solves your communication challenge. But the real transformation happens when your policy, claims, and portal systems work together, giving you the visibility, efficiency, and control you need to run a modern self-insured group.

Simplify policy administration from quote to audit with TruePolicy™

Stop juggling spreadsheets and outdated systems. TruePolicy streamlines payroll reporting, automates renewals and endorsements, and gives you real-time visibility into every policy in your book. When your CFO asks for financial forecasting data, you have it in minutes, not days.

What you get:

Automated billing and payment processing that reduces errors

Compliance reporting that's audit-ready by default

Real-time data for better budgeting and risk management

Workflows that eliminate manual data entry

Handle claims faster without sacrificing accuracy with TrueClaims™

Your claims team deserves tools that match their expertise.

What you get:

30% reduction in claims processing time through smart automation

Advanced fraud detection that spots suspicious patterns early

Integrated medical management that keeps costs under control

Reporting that shows exactly where bottlenecks exist

Give your members the self-service experience they expect with TruePortals™

Your member employers and their employees want answers now, not next week. TruePortals provides 24/7 self-service access to policy documents, claims status, certificates of insurance, and more. Reduce your inbound calls while improving satisfaction.

What you get:

Custom-branded portals that feel like an extension of your team

Mobile-responsive design that works on any device

Secure document management and e-signature capabilities

Real-time updates that keep everyone in the loop

The Integration Advantage

When your policy, claims, and portal systems talk to each other seamlessly, your data becomes actionable. Your technology and data leaders appreciate that True’s platform integrates without disrupting your existing workflows. Your executive team loves that you can finally make strategic decisions based on real-time insights, not month-old reports.

Let's pick up where MCSIGA left off

Senior Solutions Advisor

Conference sessions are great for big ideas, but the real work happens in the follow-up conversations. The ones where we dig into your specific challenges, explore solutions that fit your operations, and map out what transformation could actually look like for your group.

Ryan Smith connected with many of you at MCSIGA, and if you didn’t get a chance to talk (or if you did and want to go deeper), now’s the time.

What we’ll cover:

- A detailed look at Vera and how AI-powered communication could work for your specific team structure

- Updates to TruePolicy, TrueClaims, and TruePortals and how they address the challenges you mentioned at the conference

- What’s happening in Michigan’s regulatory landscape and how it affects your tech decisions

- Your specific pain points and whether True might be a fit

No pressure. No commitment. Just a conversation between MCSIGA members who get it.

Resources

The New AI Blueprint for Fighting Workers’ Comp Fraud

Workers’ compensation fraud continues to evolve, and so do the tools used to stop it. This blog breaks down how AI-driven fraud detection is helping insurers uncover hidden patterns, accelerate investigations, reduce false positives, and strengthen overall outcomes through smarter, more precise detection.

Smarter AI Investments in Workers’ Comp: A Leadership Guide to True ROI

AI in workers’ comp isn’t about hype, it’s about value. This guide breaks down real-world ROI timelines, total cost of ownership, and how True’s integrated solutions help leaders invest smarter.

AI in Workers’ Compensation: Key Insights from 2025 and What Comes Next

Artificial intelligence is already reshaping workers’ compensation—from claims and fraud detection to safety and underwriting. This blog breaks down the most impactful trends from 2025 and reveals where insurance leaders should focus next to gain strategic advantage in 2026.

True Returns to Sponsor the 2025 MCSIGA Annual Fall Conference

True Insurtech Solutions will once again join the 2025 MCSIGA Annual Fall Conference, October 16–17 at St. John’s Resort in Plymouth, Michigan. As both a sponsor and MCSIGA member, True looks forward to connecting with Michigan’s self-insured workers’ compensation community. Senior Solutions Advisor Ryan Smith will be on-site to meet with fellow attendees and MCSIGA members throughout the event.

Something New Is Coming to Workers’ Comp

Workers’ compensation communication is broken—and everyone feels it. From claims and underwriting to marketing and compliance, teams struggle with slow, inconsistent messaging that frustrates customers and drags down efficiency. Next Tuesday, October 7, a new standard will be unveiled—one that promises speed, clarity, and confidence in every interaction. Don’t miss the reveal.

Resilient by Design: Proactive Strategies for Managing Tariff-Driven Drug Costs in Workers’ Comp

The proposed 25% pharmaceutical tariffs could significantly increase drug costs and disrupt treatment in workers’ compensation. Learn how insurers and employers can mitigate risk using True’s adaptive technology.

Powered by True