Big data is transforming workers’ compensation insurance by providing valuable insights into customer behavior, risk factors, and operational performance. Insurers can use this data to drive smarter decision-making, improve efficiency, and create better customer experiences. In this blog, we’ll explore the challenges of managing big data and how companies can tap into its full potential to fuel sustainable growth.

The Growing Importance of Big Data in Insurance

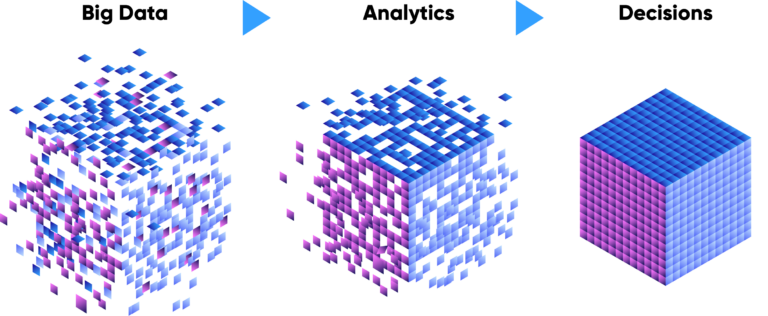

Big data refers to the large volumes of structured and unstructured data collected from multiple sources like customer interactions, claims data, social media, and economic indicators. In workers’ compensation insurance, big data can reveal critical insights into customer behavior, risk factors, and market trends, all of which are essential for driving growth.

True solutions integrate these data streams into a unified platform, allowing insurers to make data-driven decisions that enhance operational efficiency, improve underwriting, and optimize customer experience.

The Challenges of Managing Big Data

While big data offers immense potential, it comes with significant challenges for insurers, particularly in workers’ comp:

- Data Overload: The vast amount of data available can be overwhelming, making it difficult to identify the most valuable data for decision-making.

- Data Silos: Separate systems and siloed data limit the comprehensive view needed for strategic decision-making.

- Complexity of Analysis: Analyzing big data requires advanced tools and expertise, often beyond the capabilities of traditional insurance IT infrastructures.

How Insurers Can Overcome These Challenges

To fully harness the power of big data, insurers must adopt modern technologies that integrate data from multiple sources. True’s suite of policy, claims, and portal solutions break down silos and provides a centralized platform that enables a holistic view of operations. With advanced analytics, insurers can gain actionable insights that enhance risk assessment, customer segmentation, and claims management.

How Big Data Drives Growth in Workers’ Compensation Insurance

Big data can drive growth in several critical areas for workers’ compensation insurers:

1. Enhancing Risk Assessment and Underwriting

Accurate risk assessment is foundational to effective underwriting. Big data allows insurers to analyze diverse factors such as customer behavior and historical claims data to create more accurate pricing models. TruePolicy™ leverages analytics to support advanced risk assessment, improving underwriting precision and profitability.

2. Improving Customer Segmentation and Targeting

By analyzing customer behavior and preferences, insurers can better segment their customer base and tailor marketing strategies accordingly. With TruePortals™, insurers can deliver targeted, personalized experiences that improve customer retention and acquisition.

3. Optimizing Claims Management

Efficient claims management is vital to reducing costs and improving customer satisfaction. Big data analytics can streamline the claims process, identify fraud patterns, and reduce processing times. TrueClaims™ offers advanced analytics to enhance claims management efficiency.

4. Predictive Analytics for Better Decision-Making

Predictive analytics powered by big data enables insurers to anticipate future trends and make proactive decisions. By analyzing historical data, insurers can forecast customer behavior and market shifts. TruePolicy integrates predictive analytics to help insurers drive growth and ensure long-term success.

5. Enhancing Customer Experience Through Personalization

Personalization is increasingly crucial in the workers’ compensation space. By leveraging big data, insurers can tailor communications and services to each customer’s specific needs, enhancing satisfaction and loyalty. TruePortals allows for personalized customer interactions at scale, strengthening long-term relationships.

Implementing a Big Data Strategy in Your Insurance Business

Insurers looking to harness the power of big data should take the following steps:

Define Your Objectives

Start by identifying what you want to achieve with your big data strategy. Whether it’s improving underwriting accuracy or optimizing customer service, clear objectives will guide your data initiatives.

Invest in the Right Technology

Big data requires robust tools to manage, analyze, and act on the data. True provides integrated big data solutions tailored to the insurance industry, ensuring seamless data management and real-time analytics.

Foster a Data-Driven Culture

A successful big data strategy must be embedded within your organizational culture. To help build a culture where data-driven decision-making becomes second nature, equip teams with the skills to leverage big data effectively.

Ensure Data Quality and Governance

Data is only as valuable as its quality. Implement robust governance protocols to ensure data accuracy and security, adhering to industry standards. True offers comprehensive data governance features, ensuring the integrity of your data.

The Future of Big Data in Workers’ Compensation Insurance

As the industry evolves, big data’s role in workers’ compensation will continue to expand. By embracing AI and machine learning, insurers will be able to process vast amounts of data quickly and make real-time decisions that drive growth.

Harnessing big data is essential for insurers aiming to drive growth in workers’ compensation. By adopting integrated platforms like True, insurers can overcome the challenges of managing big data and unlock new opportunities for growth and operational efficiency.

For more insights on the hottest topics in the insurance industry and to stay updated on the latest trends, join the True Community, or contact Ryan Smith at ryan@experiencetrue.com to discuss how True solutions can help you harness the power of big data in your insurance operations.